Why CADFi?

At CADFi, we're not just another financing option; we're your agricultural financial partner, and we bring a unique approach to the table that sets us apart from traditional financing solutions. Here's why CADFi stands out:

Click Here For Trucks, Dealers, Financing, & Protection Plans

CADFi sets the standard in ag finance with bundling and flexible payment choices, tailored to your agricultural needs.

CADFi sets the standard in ag finance with bundling and flexible payment choices, tailored to your agricultural needs.

At CADFi, we're not just another financing option; we're your agricultural financial partner, and we bring a unique approach to the table that sets us apart from traditional financing solutions.

Financing Up To

$5M

Loan Terms From

24-84Mos

Flexible Payment Terms (Optional)

Annually

Funding In As Little As

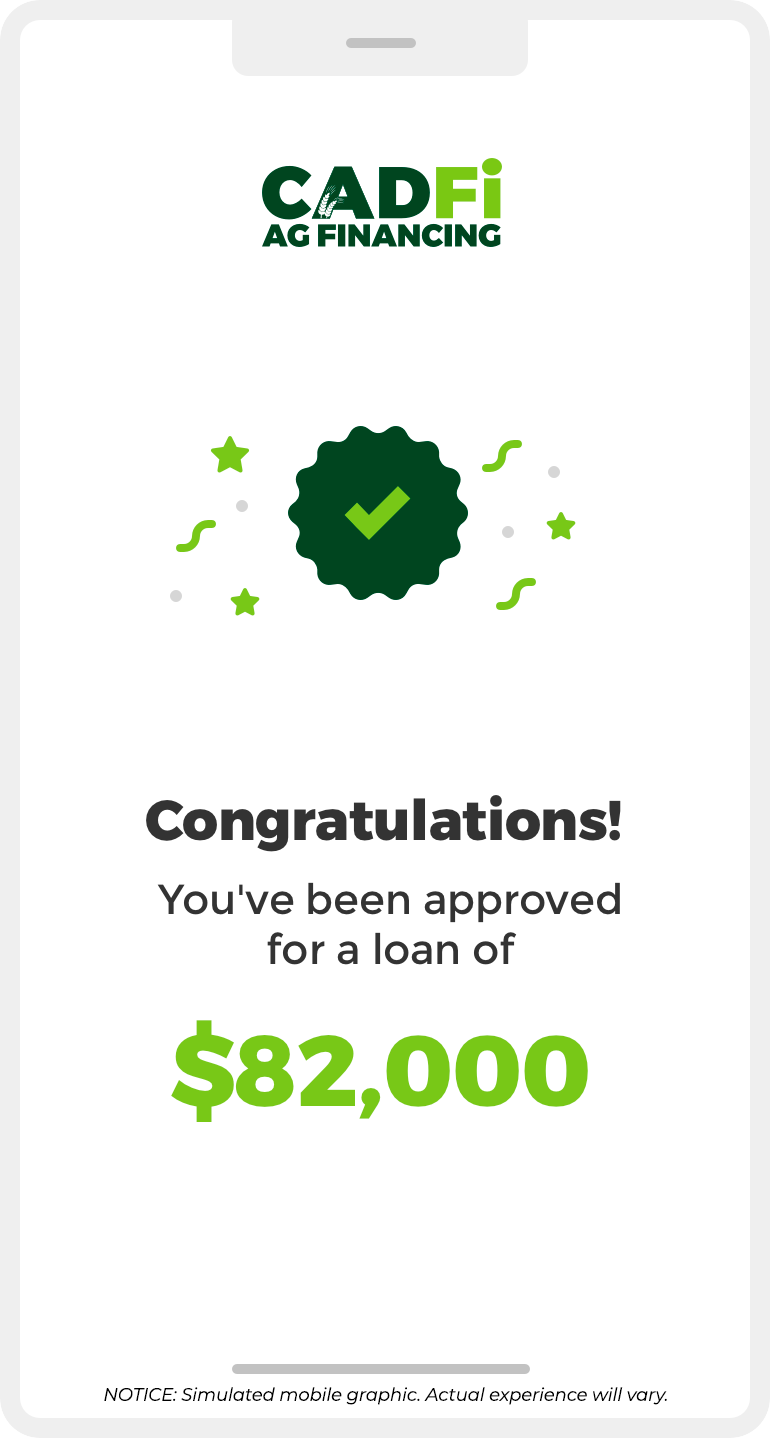

1-2Days

Loan amounts are subject to approval based on credit assessment and financial eligibility. Rates may vary based on creditworthiness, loan term, and other factors.

Get Pre-QualifiedAt CADFi, we're not just another financing option; we're your agricultural financial partner, and we bring a unique approach to the table that sets us apart from traditional financing solutions. Here's why CADFi stands out:

CADFi lets you pick payment terms, monthly, quarterly, semi-annually, or annually, that match your operation's needs.

With CADFi, it's not just about financing a truck. Bundle truck(s), machinery, equipment, and supplies into a single, comprehensive loan.

Refinancing with CADFi is a smart financial move for farmers and ranchers looking to optimize their existing loans. Whether you have an existing loan with unfavorable terms or simply want to take advantage of CADFi's competitive rates, our refinancing process is designed with your financial well-being in mind. By choosing CADFi, you gain access to flexible payment terms, the option to bundle additional equipment, and a streamlined process that makes managing your loans more efficient. Plus, with our team of experts guiding you through the refinancing journey, you can trust that your financial future is in capable hands.

Get Pre-QualifiedI'm excited about CADFi. The flexible terms allow us to match our loan payments with our cash flow and adding some equipment purchases into the loan is a bonus and simplifies things for us.

Getting a loan through CADFi is a straightforward process designed to meet your agricultural financing needs. Here are the steps:

Begin by completing the pre-qualification application, providing basic information about your farm or ranch and financing needs.

A CADFi representative will contact you for a consultation and request necessary documentation to assess your eligibility and loan terms.

Once approved, review and accept the loan terms. Complete the closing process, including signing the loan agreement.

CADFi disburses funds to the designated parties, and you start making payments according to the agreed-upon schedule and terms.

Getting pre-qualified with CADFi is hassle-free, with no obligation to commit, and rest assured, your information is kept secure and confidential.